To figure out where things are going, we need to ask what exactly is inflation, how is it measured and what is the cause of inflation? Here’s how those are defined:

- Inflation is a decrease in the purchasing power of money, reflected in a general increase in the prices of goods and services in an economy.

- Measuring inflation, also know as the “Consumer Price Index” (CPI), is produced by the Bureau of Labor Statistics and is the most widely used measure of inflation. The primary CPI is designed to measure price changes faced by urban consumers who represent 93% of the US population. It is just an average, and does not reflect any particular consumer’s experience. The CPI is constructed each month by using 80,000 items in a fixed basket of goods and services representing what Americans buy in their everyday lives – from gasoline at the pump and apples at the grocery store to cable tv fees and doctors visits. The BLS uses a survey of American families called the Consumer Expenditures Survey to determine which items go in the basket and how much weight to assign to each of them. Different prices are weighted according to how important they are to the average consumer. For instance, Americans spend more on chicken than on tofu, so changes in the price of chicken will have a greater impact on the CPI.

Causes of inflation are various. Typically, inflation results from an increase in production costs or an increase in demand for products and services. When both occur, it moves much more quickly.

Cost-push inflation occurs when prices increase due to increases in production costs, such as raw materials and wages. The demand for goods is unchanged while the supply of goods declines due to the higher costs of production. As a result, the added costs of production are passed onto consumers in the form of higher prices for the finished goods.

One of the signs of possible cost-push inflation can be seen in rising commodity prices such as oil and metals since they’re major production inputs. For example, if the price of copper rises, companies that use copper to make their products might increase the prices of their goods. If the demand for the product is independent of the demand for copper, the business will pass on the higher costs of raw materials to consumers. The result is higher prices for consumers without any change in demand for the products consumed.

Wages also affect the cost of production and are typically the single biggest expense for businesses. When the economy is performing well, and the unemployment rate is low, shortages in labor or workers can occur. Companies, in turn, increase wages to attract qualified candidates, causing production costs to rise for the company. If the company raises prices due to the rise in employee wages, cost-plus inflation occurs.

Demand-pull inflation can be caused by strong consumer demand for a product or service. When there’s a surge in demand for a wide breadth of goods across an economy, their prices tend to increase. While this is not often a concern for short-term imbalances of supply and demand, sustained demand can reverberate in the economy and raise costs for other goods; the result is demand-pull inflation.

Consumer confidence tends to be high when unemployment is low, and wages are rising—leading to more spending. Economic expansion has a direct impact on the level of consumer spending in an economy, which can lead to a high demand for products and services.As the demand for a particular good or service increases, the available supply decreases. When fewer items are available, consumers are willing to pay more to obtain the item—as outlined in the economic principle of supply and demand. The result is higher prices due to demand-pull inflation.

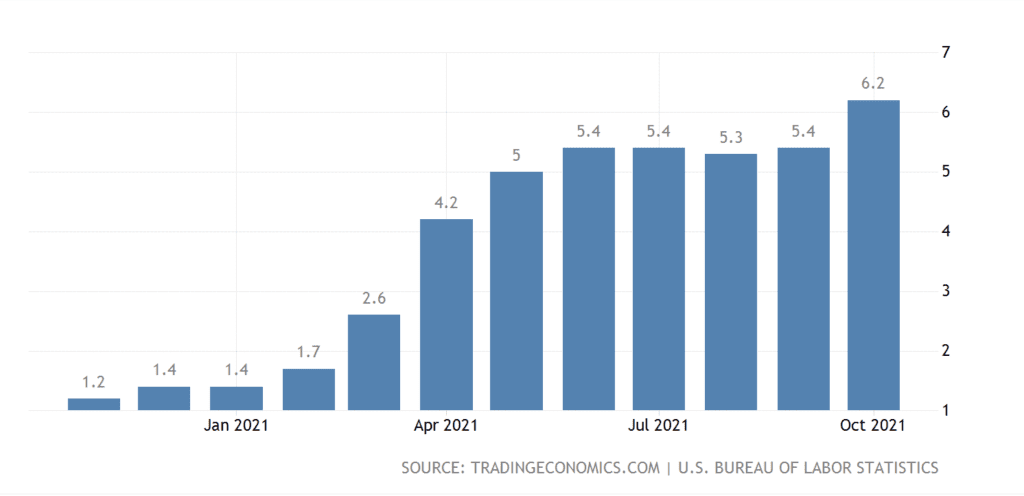

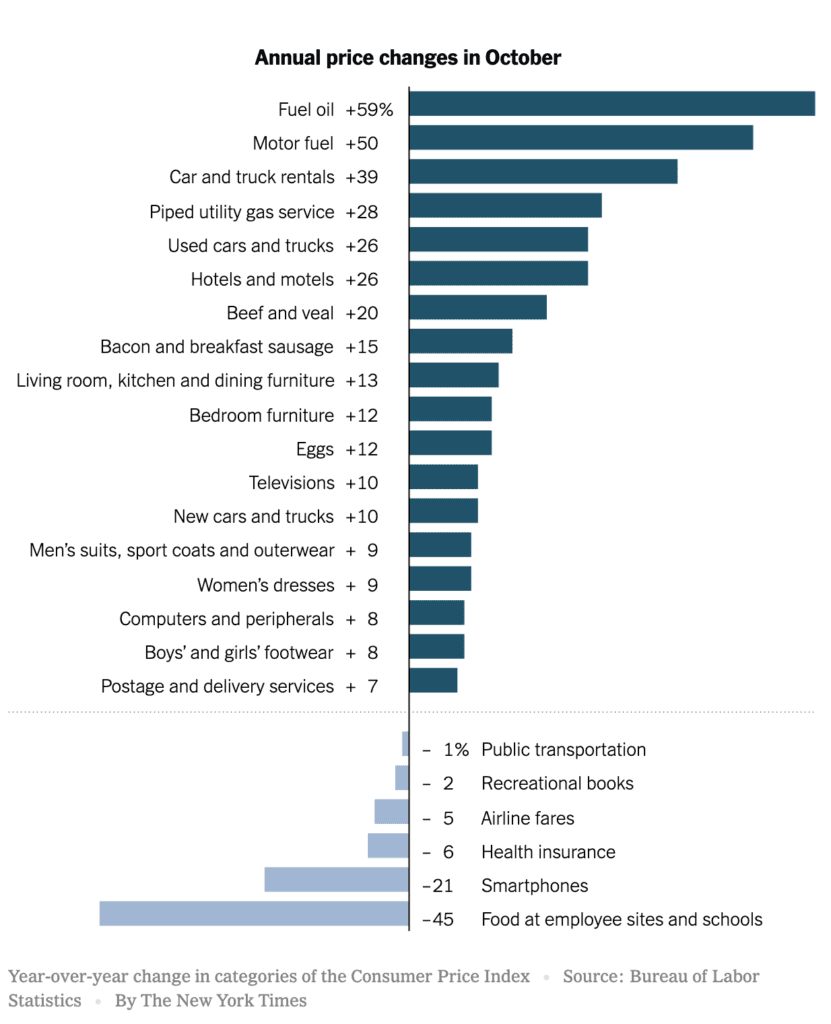

But, of course, you noticed… Car-rental prices for leisure travel were up 43% in October 2021 compared with October 2020, according to the Federal Reserve Bank of St. Louis… The average cost of a gallon of regular gas, according to the American Automobile Association, is up 62% over the past year ‒ to $3.42 per gallon… The list could go on. The chart below shows where we are.

How does inflation affect the average person?

Inflation raises prices, thus lowering your purchasing power. This is especially true if your income doesn’t keep pace with inflation. Inflation also impacts your retirement as it lowers the value of pensions, savings, and Treasury notes. Some inflation is actually healthy as people learn to expect it and spend now rather than later. The Federal Reserve sets an inflation target with a healthy core inflation rate of 2%. (Core CPI is CPI without food and fuel prices factored in.) Currently the annual core CPI rate is 4.6% as of October 2021. This high inflation rate hurts the economy and diminishes the average standard of living.

How could inflation affect the interest rates?

Inflation will also affect interest rate levels. The higher the inflation rate, the more interest rates are likely to rise. This occurs because lenders will demand higher interest rates as compensation for the decrease in purchasing power of the money they are paid in the future (Investopedia). The Federal Reserve seeks to control inflation by influencing interest rates. When inflation is too high, the Federal Reserve typically raises interest rates to slow the economy and bring inflation down. When inflation is too low, the Federal Reserve typically lowers interest rates to stimulate the economy and move inflation higher. Will the rates increase in the near future ? We will have to wait and see.

How does an increase in interest rates affect the real estate industry? Will it affect commercial real estate the same as residential real estate?

In residential real estate a 1% increase in rates can start to change the dynamics of the market.

From a home buyer’s perspective, as mortgage rates increase, affordability decreases. For exampe, Johnny Home Buyer wants to qualify for a $400,000 mortgage at 4% interest, but at 5% interest, lenders can only offer Johnny a $355,000 loan based on his qualifications. A 1% increase in mortgage interest decreases Johnny’s purchasing power by $45,000. Rising mortgage rates affect sellers as well, though differently. For example, if Jill wants to sell her house for $400,000, she is more than welcome to list her home at that price. Due to rising interest rates, however, potential buyers can only afford Jill’s home at $355,000. Indisputably, she can still make a profit on the sale, but only a 1% increase in mortgage rates diminishes the market value of Jill’s home by about $45,000.

For commercial real estate, if fewer people qualify for a mortgage they want, that will begin to put pressure on the rental market. This may be good for Multi-Family investing, as rents could increase even more than they have for the last five years, which then may increase the value of the underlying property. On the commercial side, rising rates can potentially slow down the number of transactions or make more properties more likely to have portions of seller financing for completion of the sale. More innovative means of financing is potentially a tool to help complete a sale.

Business will usually find a way to make things happen, it just becomes more difficult and innovation becomes the key to success.

– Written by Dave Garvey & Laura Stoll.

Information sourced from Investopedia, NY Times, Trading Economics, Federal Reserve Bank, and others.