The Placer.ai Nationwide Office Building Index: The office building index analyzes foot traffic data from 800 office buildings across the country. It only includes commercial office buildings and commercial office buildings on the first floor (like an office building that might include a national coffee chain on the ground floor). It does NOT include mixed-use buildings that are both residential and commercial.

The “remote work war” continues to grab headlines, with employees speaking out against accumulating back-to-office mandates, and pundits weighing in on all sides. Depending on one’s point of view, more time at the office is either vital for creative collaboration and individual career advancement – or an unnecessary burden on employees struggling to maintain a healthy work-life balance.

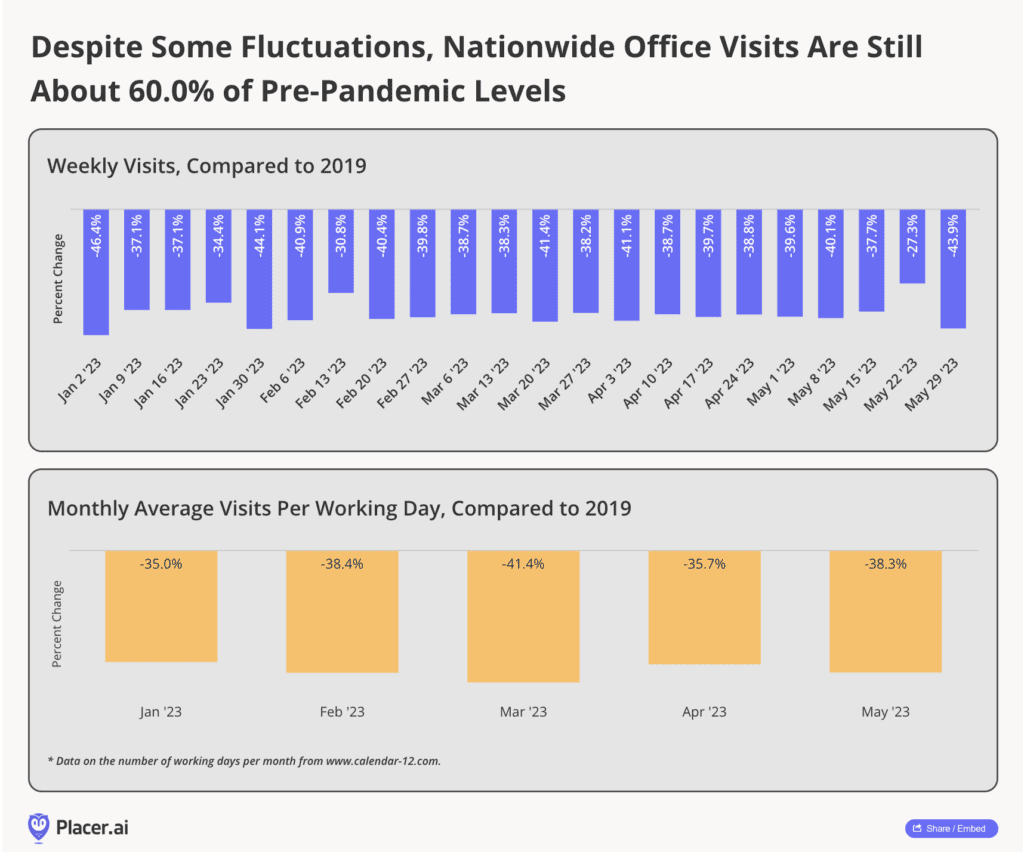

But against the backdrop of this boisterous debate, workers and employees nationwide are quietly voting with their feet. Office visitation patterns have remained remarkably steady over the past several months – with foot traffic remaining at about 60.0% of pre-pandemic levels since the second half of 2022. Punditry aside, it appears that most remote-capable jobs have calmly settled into a hybrid routine that enables both workers and companies to forgo the five-day-a-week commute while reaping the benefits of some in-person work.

Persistent Hybrid Pattern

For most weeks since January 2023, office buildings nationwide have maintained a visit gap hovering around 40.0% of 2019 levels (The unusually small visit gap during the week of May 22nd appears to stem from Memorial Day falling on May 27th in 2019). And when accounting for the number of working days each month, the monthly visit gap also remained relatively steady, fluctuating between 35.0% and 41.4%.

Just Another Manic Tuesday

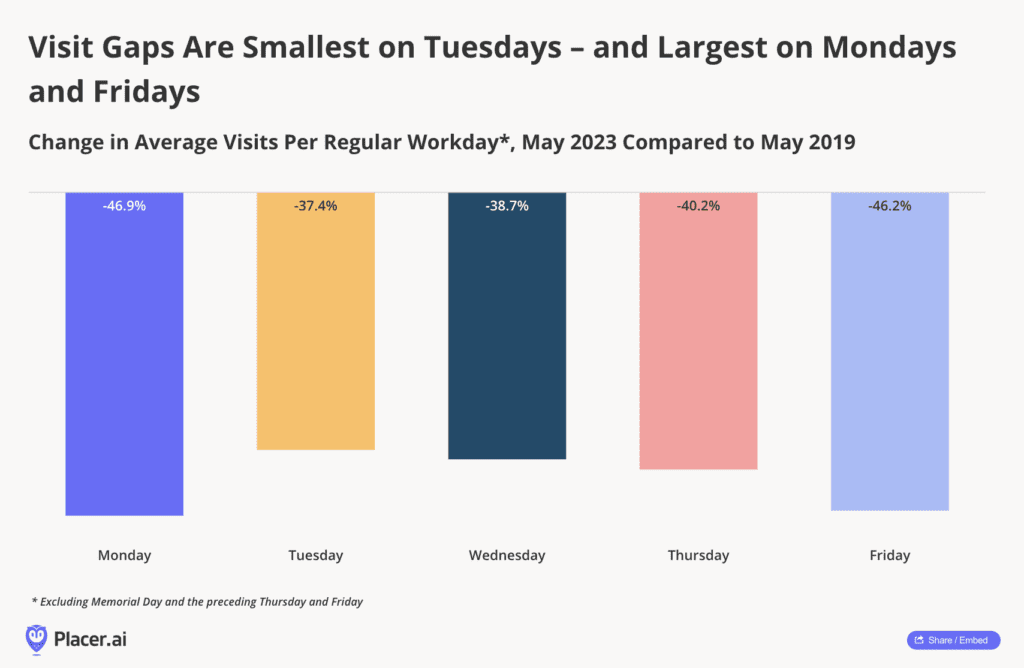

As we’ve noted before, office visits are increasingly being concentrated in the middle of the week, with many workers choosing to work from home on Mondays and Fridays. And comparing May 2023 visit gaps across days of the week appears to demonstrate the solidification of this trend. The year-over-four-year (Yo4Y) office visit gap was smallest on Tuesdays, with Wednesdays and Thursdays not (too) far behind. Mondays and Fridays, on the other hand, stood out as WFH favorites, with office visits just over half of what they were in 2019.

A Tale of 11 Cities

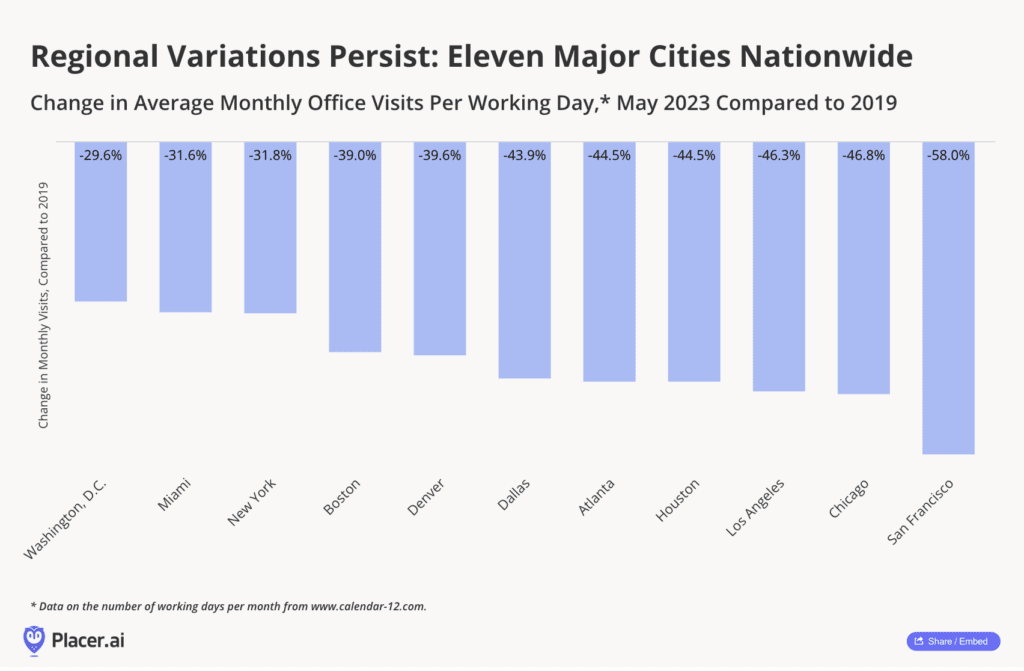

The impact of this semi-permanent decline in office foot traffic is being felt across cities nationwide, taking its toll on everything from municipal tax revenue to local restaurants and retail stores. The sea-change in work patterns is also shifting urban centers of gravity away from office-heavy downtowns and towards more residential districts, affecting local housing markets.

But while many of these challenges are common to big cities throughout the country, the extent of office recovery continues to vary across regions.

Key Takeaways

“An office,” Michael Scott insisted dreamily in a much-watched episode of The Office, “is a place where dreams come true.” But be that as it may, post-pandemic America has settled into a pretty stable routine that tries to straddle the divide between remote and in-person work. How will this new normal continue to evolve? And how will cities, retailers, and other stakeholders continue to adapt?

Follow Placer.ai’s location intelligence analyses to find out.

Coastal Land & Commercial Groups Takeaways

The Placer.ai Office Index provides valuable insights into the ongoing debate surrounding remote work and office attendance. The data shows that despite the vocal discussions and differing opinions on the matter, employees across the nation are quietly making their preferences known through their foot traffic patterns.

It is interesting to note that office visitation has remained steady at around 60% of pre-pandemic levels since the second half of 2022. This suggests that a majority of remote-capable jobs have embraced a hybrid work model, allowing for a balance between in-person and remote work. This approach enables both employees and companies to reap the benefits of collaboration and flexibility while avoiding the burdensome daily commute.

Furthermore, the data reveals a shift in office visits towards the middle of the week, with Tuesdays standing out as the day with the smallest visit gap. This indicates a trend where employees choose to work from home on Mondays and Fridays, making Tuesdays a popular day for in-person collaboration.

The impact of reduced office foot traffic is not limited to workplaces alone; it affects cities and local businesses as well. The decline in office visits has significant implications for municipal tax revenue, as well as the dynamics of urban centers. The shift towards more residential districts is reshaping housing markets and affecting local retailers and restaurants.

As we navigate this “new normal,” it will be crucial to monitor how these trends evolve and how cities, retailers, and other stakeholders adapt. Understanding the changing dynamics of office attendance is essential for informed decision-making and effective planning. Placer.ai‘s location intelligence analyses provide valuable insights into these developments and can serve as a resource for those interested in tracking the evolving landscape of work.

— Viktoria Alkova & Ethan Ash

Original Placer.AI article by Lila Margalit