As we close in on the end of 2023, we are thinking about 2024 and what it will hold for the real estate industry. There appears to be a wide variety of views and a lot of interesting issues that will only become more evident as the year progresses.

Construction

In construction, specific kinds of materials are increasing or decreasing in costs. Some construction items have stabilized, while others are still fluctuating – and the increases and decreases are not specific to categories, but specific items. For instance, dimension lumber has dropped significantly, while sheet goods have stayed at the higher levels that they skyrocketed to in 2021 and 2022.

Windows and doors have stayed somewhat level, and supply chain issues appear to have abated for the most part. Government mandates, however, on energy efficiency could push window and door prices higher in the coming year if the only way to attain the efficiency level is to go to a triple pane glass window. This will likely require retooling at some of the manufacturers, posing potential supply chain problems again.

All of this is pushing the average cost of building a starter home higher all the time. The same applies to commercial construction, both multi-family and industrial and warehouse. In multi-family, costs per unit have been pushed to levels we have not seen previously.

Site Work

Site work pricing has gone out of sight. Subdivision roads for residential properties are anywhere from $800 per linear foot (PLF) to over $1,200 PLF. A small site contractor was recently complaining that their fuel bill was now over $25,000 per month. Cost increases have extended over to the commercial sites as well, especially given the requirements for drainage and storm water retention.

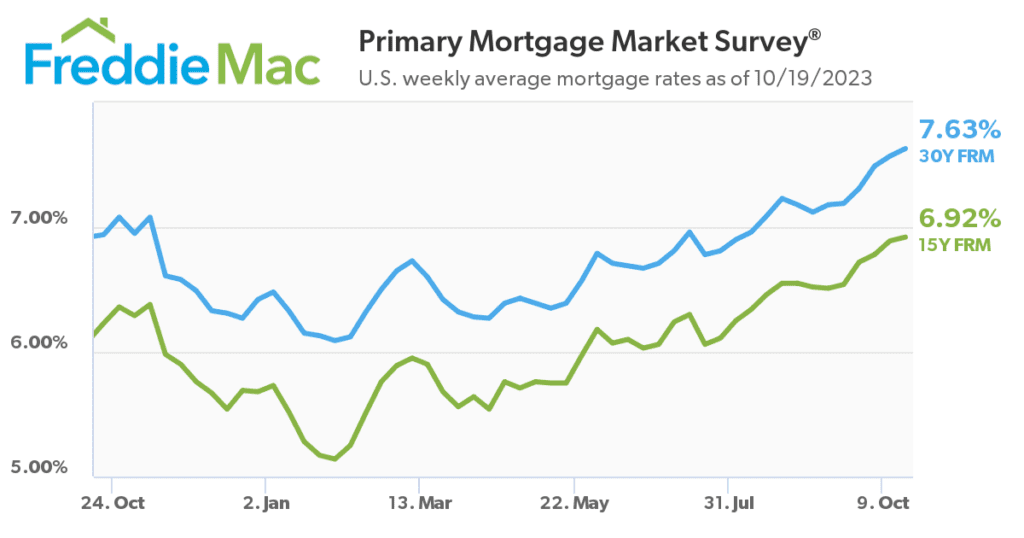

Add to that mixture, the residential end user interest rates. For the week of Oct 19, 2023 the average was 7.63% for a 30-year, fixed rate loan according to Freddie Mac.

Construction loans are in the mid 8’s to high 9% range. That makes it harder for the average builder to make sense of it, even with a high demand. Per square foot prices are also on the rise, given labor costs, fuel costs and of course material costs. The FED’s desired outcome of slowing the economy to tame inflation appears to potentially be working.

Effects on Real Estate

How does all of this affect us in the commercial real estate world? Well, for starters, the higher costs make it more difficult to pencil out projects – especially in Multi-families. Banks are nervous, with some even limiting to a very narrow field of what they will lend on. Most will not go near office properties because that environment is too volatile. Retail is also not in their favorite bucket. Banks are changing their DSCR’s, tightening them up, as well as requiring greater amounts of down payments. Additionally they are tending towards only the very well qualified borrowers. Owner users have issues finding inventory that meets their needs, but when they do, they look to SBA programs to get them into the property. SBA appears to be still very viable as an option for an owner-user.

It seems that there is a lot of cash sitting on the sidelines. We can almost feel the tension as sellers try to hold to their pricing while well qualified buyers are looking for deals that don’t exist yet. It takes well seasoned professionals to bring the parties together, matching motivated sellers and buyers and negotiating through the complicated process in today’s environment.

All of this is a signal to sellers that they need to be realistic in their pricing, willing to accept that buyers will not have the same easy time with banking needs as they have had in the past. Sellers will need to be open to innovative ways to put deals together. Inventory (or lack of it) is still in the seller’s favor for now, but in the coming year that could begin to change – creating more opportunity for everyone.

Loan resets next year could begin to change the face of the market. Many 5-year notes will be coming due for a rate hike. A change from 4 or 5 percent to 7% or 8% could be challenging for borrowers.

All in all, given supply constraints, and other outside market factors, next year should prove to be a good year for movement in commercial real estate. As always, it will certainly be exciting!

– Dave Garvey