COVID IMPACTS – TEMPORARY AND PERMANENT

Moving is expensive, time-consuming, and emotionally and socially costly, so even a slight uptick in internal migration is significant. We saw a great deal of migration immediately after the shut down in 2020 as cities saw many of their residents, who were no longer tied to an office, move to smaller communities. When a small town sees an influx of newcomers, it can impact the way the community operates, the services it needs to provide, and the retail opportunities it presents. Small New England towns and cities saw many people arriving from NYC, Boston, and other nationwide cities, which had a fairly noticeable impact on normal traffic and seasonality. Small shifts in population have an oversized impact on smaller markets, so businesses that can identify up-and-coming cities, counties, and states can see major growth while benefiting from less competition.

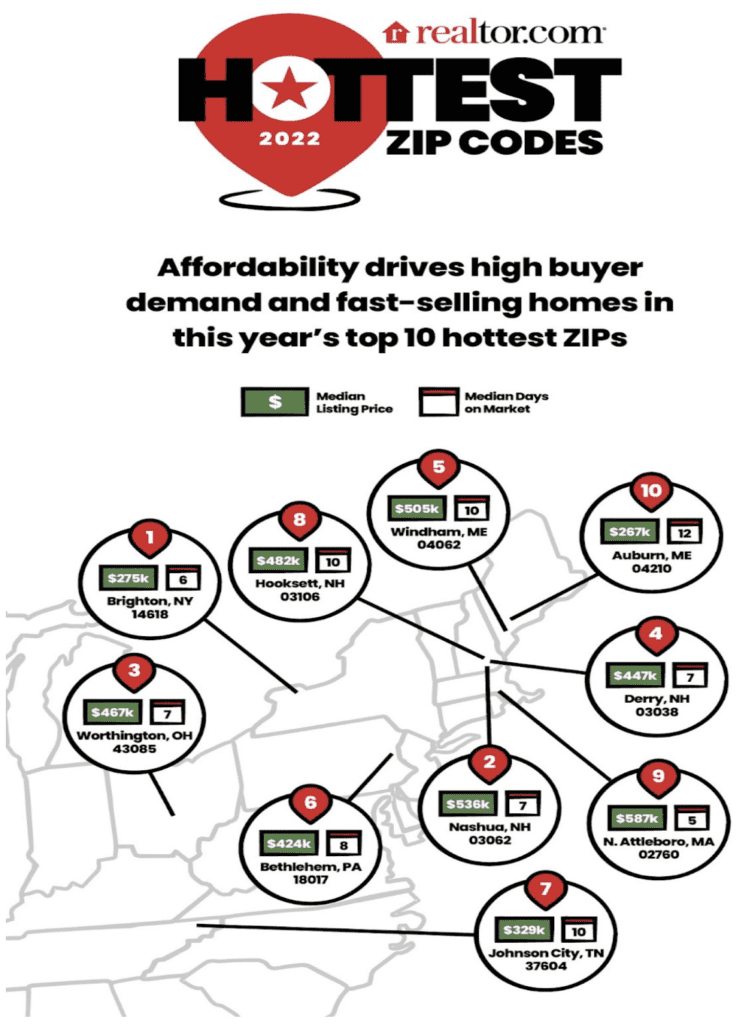

6 of the top 10 hottest zip codes in the nation in 2022 were in New England :

- Nashua, NH (is 2nd most popular zip code)

- Derry, NH

- Windham, ME

- Hooksett, NH

- North Attleboro, MA

- Auburn, ME

This is a shift from the majority of the top fastest selling national zip codes being in the south or west. As the communities see such an influx in demand that is driving housing prices higher and higher, the real question is “what are the long term impacts of this increasing population and demographic makeup?”. When people relocate, they often look for their favorite brick-and-mortar brands in their new home town, creating opportunities for retailers and local business owners.

Migration can be a boon for retailers entering smaller markets. What has been quite an increase to business in the New England region’s commercial industry is the demographic uptick. While the New England area, on average, has higher median household income and net worth than the rest of the nation (outside of California), these high median income communities were typically concentrated in and around urban cities, such as Boston and New York. Now, though, the smaller towns are benefiting from the higher paid employees who no longer live in the urban cities and shopping in places like Portsmouth, North Attleboro, and Worthington.

HIGHEST RETAIL INCREASE

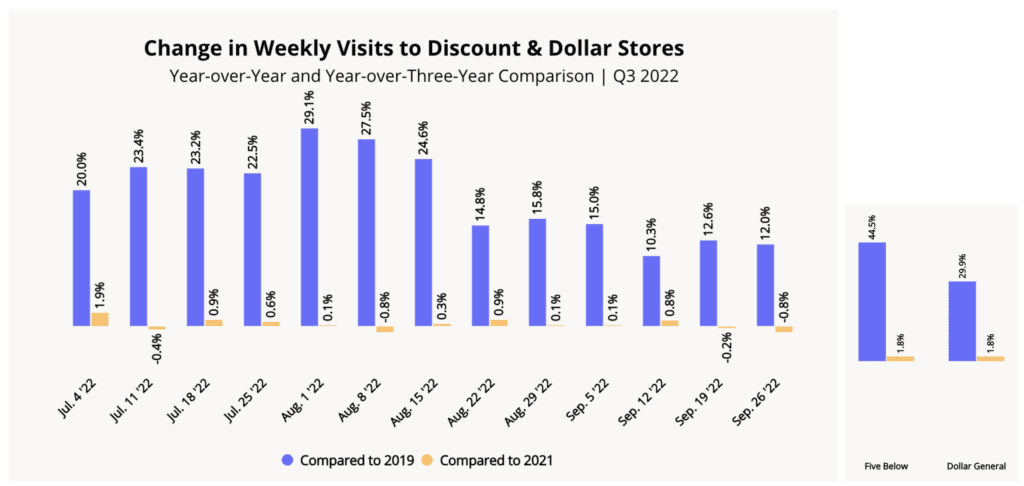

Now while the demographics of these smaller communities are improving the retail market, what has seen the greatest increase across the board is discount stores (i.e. dollar stores). Weekly traffic to discount stores has been 10%-29% greater than pre-pandemic levels. This increase is likely based on inflation driving shoppers to find cheaper alternatives for staple goods. The New England region is underserved in these types of retailers – Five Below and Dollar General being the two biggest winners in this category.

ANOTHER UNDER-SERVED MARKET

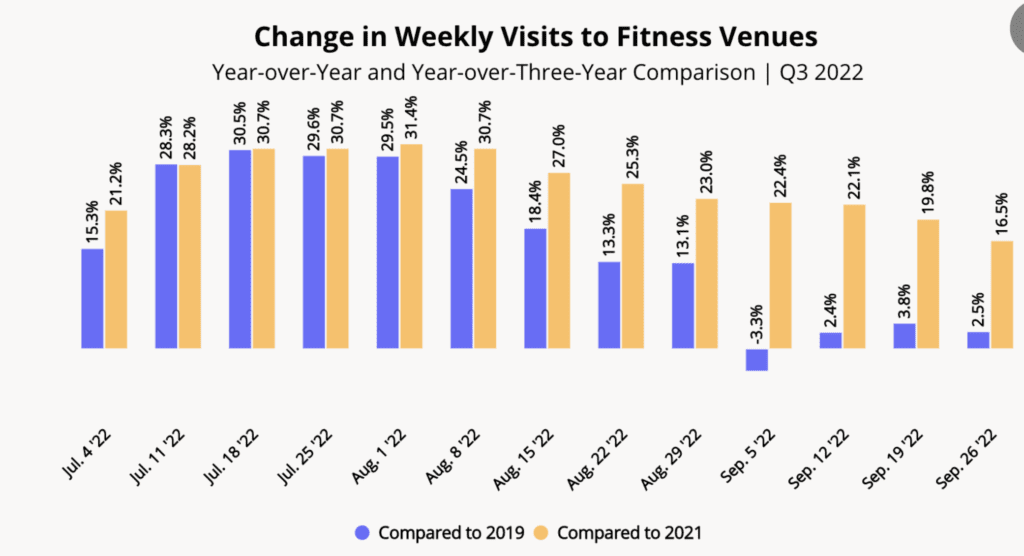

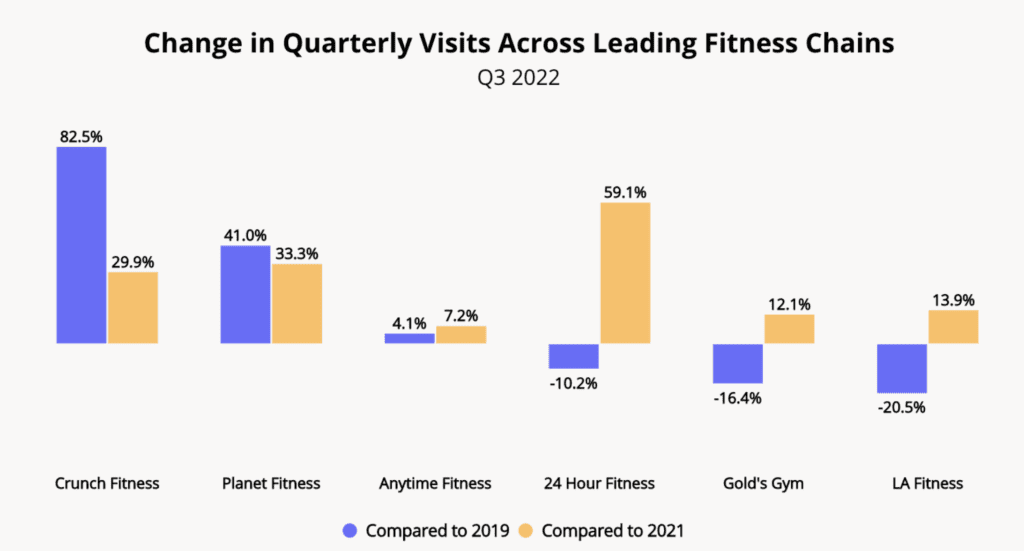

A strong retail section that has surpassed pre-pandemic levels and that is significantly underserved in the growing New England markets, in addition to discount stores, are fitness centers. Health has been a driving factor in spending habits in the past several years. Looking at numbers in pre-covid and in the past 12 months, we are seeing major increases in traffic to the gym.

While most of the top communities in New England have a Planet Fitness, the other leading fitness chains are not very well represented in the same areas. This is a great opportunity for someone looking to open a franchise in a growing field.

CONCLUSION

Overall small changes in small markets offer big business opportunities. While the exodus from cities seem to be more temporary, the stickiness seems to have had a greater impact on the Northeast. We can expect to see more population and migration growth, which in turn means increased needs for specific industries – particularly retail and fitness. It will be interesting to see who takes advantage of this opportunity and what the landscape looks like over the next few years.

—Ethan Ash & Viktoria Alkova