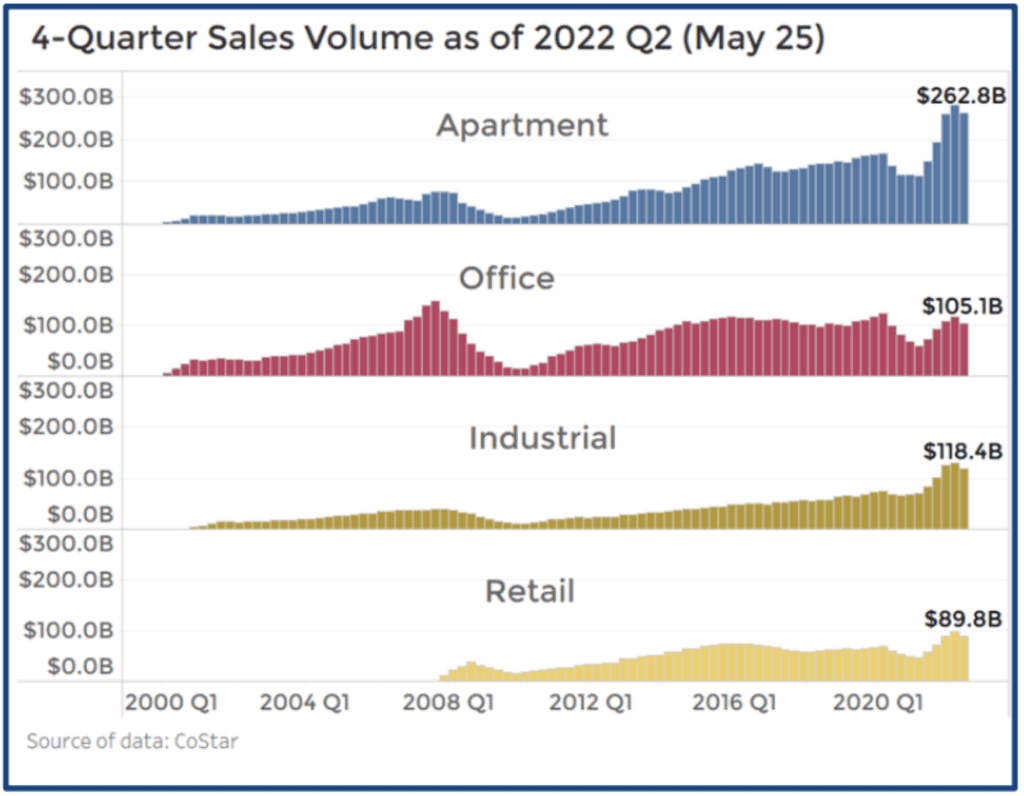

Multi-Family and apartments are still some of the hottest investment products in the commercial real estate market. In just New England (NE) this year there have been more units sold of Multi-Family than Self Storage, Senior Housing, Special Purpose, Mobile Home Parks, Retail, Office, Industrial, Land and Hotel/Motels combined! Even with a lower price per unit, apartments sales nearly exceed volumes of Office, Industrial and Retail combined as well. Seeing that the average price is lower than most of the other properties types and because of financing, it makes sense that more investors can afford to get into this investment product. We expect multi-families to continue to be a hot commodity.

Most people that are somewhat aware of the NE area know that rental rates have gone up substantially, vacancy has become non-existent, and investors seem to be purchasing these properties at abnormally high prices. The question our team wanted to explore is ‘how does this compare to the national averages’ and ‘are there some reasons or trends that we can add light to’.

Comparing New England to the National Average

We saw way more similarities than differences when looking at the national numbers compared to New England. This may be because 9.5% of all the units sold were sold in 5 states: Maine, New Hampshire, Vermont, Massachusetts, Connecticut, and Rhode Island. These states have just 4.5% of the population, but see a lot more of the overall investment capital. The median price per unit is the same in both – $130,000 in NE and nationwide. The square footage is a bit larger in NE than nationwide (2,626 SF vs. 2,305 SF).

Reasons and Trends

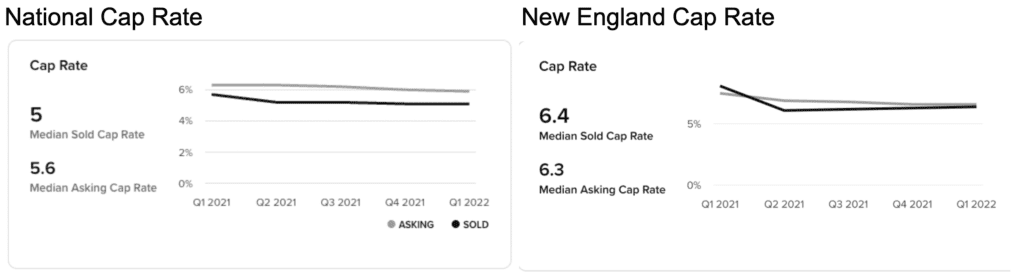

The item that was a bit of a surprise to us in this research is that NE as a whole has above average capitalization rates, which means all things being equal – investors get better returns on their investments in this area than the rest of the nation.

So what do we do with this information? Our initial thought is if the price per unit is $130,000, which is the same in NE as it is in the country, but rental rates are higher, vacancy is lower, and the market is more stable, then investing in NE seems like a great place to buy multi-family properties. Note though that the average days on market is 13 days though, so not having an agent looking for these types of properties for you is going to put you behind the 8 ball more often than not. Many of the units that are sold for less than the median sale price are done off market.

Additionally, keep in mind that if you are borrowing, you should have your lending lined up. This is a competitive market, so having your financial situation in order is key to getting your offer accepted when you do find the right property. Lastly, knowing what the numbers are will help you be sure that you are not spending too much and getting a good return on your investment.

– Ethan Ash & Viktoria Alkova