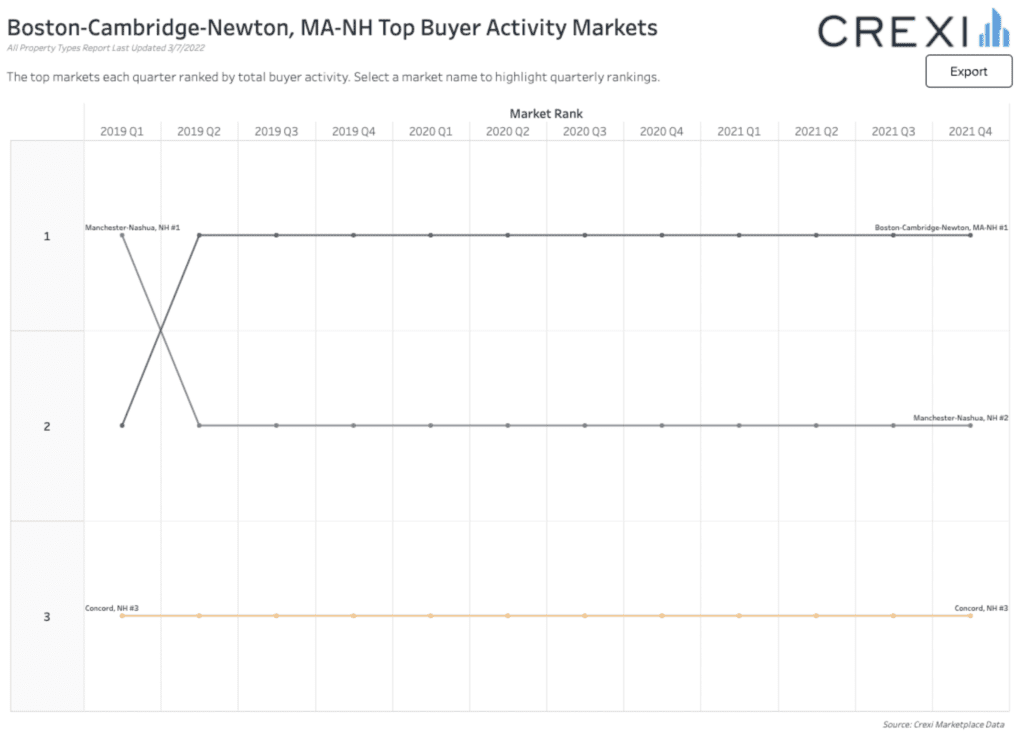

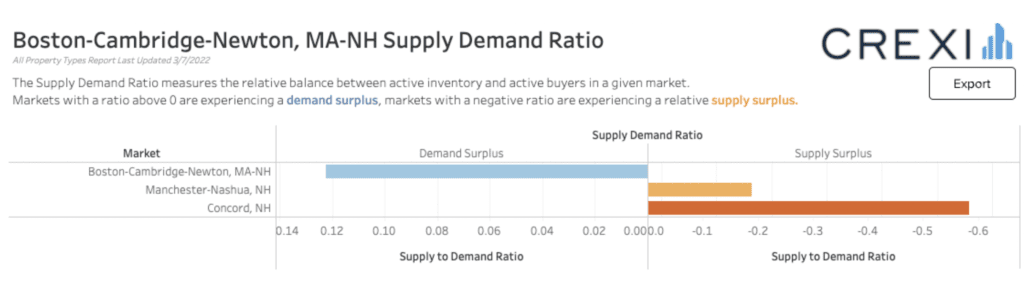

The Boston-Cambridge-Newton Market, or as we call it, Seacoast & Northshore Market, is #1 in Buyer Activity in New Hampshire for 11 straight quarters. It is also the only market in the state that has a commercial inventory “demand surplus”. It doesn’t take a commercial real estate expert to recognize that this is a market where lots of investors and businesses want to get into.

But to an outsider looking in, it might be hard to understand why this market is in such high demand and they might ask the question, “Did I miss the opportunity to invest in the Seacoast?”

Still Investment Opportunity in the Seacoast

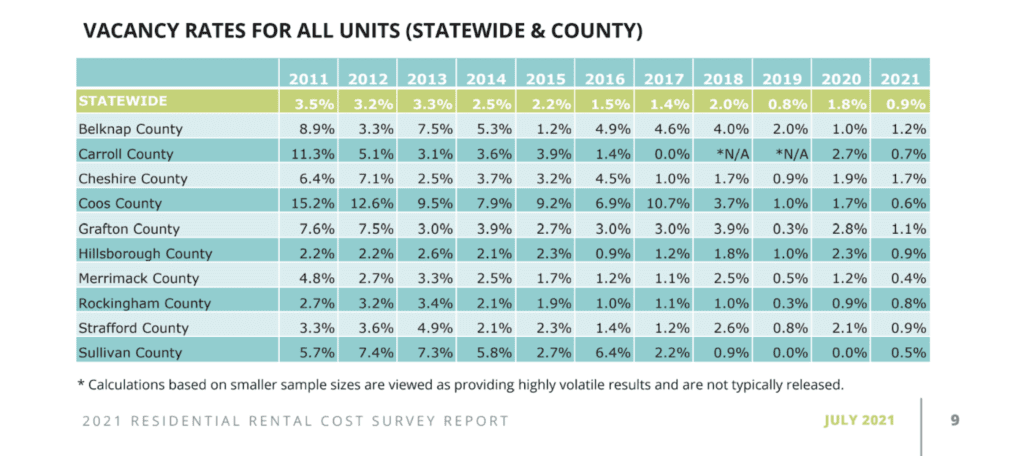

Boston is the 31st best place to live in America according to U.S News and Portsmouth is the second best place to live in NH according to Patch.com. Three other cities of the top 5 (i.e. Exeter, Hampton, Durham) are on the NH Seacoast. Dover is also in the top 10. According to Niche.com, Portsmouth is the #1 place to live for Young Professionals, and #2 best place to retire. So for young and old alike, this area attracts a great number of people. The desire for “livability” is what gives the area a large and vibrant workforce, as well as so many consumers that attract the retail and service industries. Vacancy rates for rental units in New Hampshire remained under 1% during 2021-2022.

So an outsider still might ask, “has the growth already occurred?”

There’s Still Growth Ahead

There are thousands of condos and apartments set to be constructed in the NH Seacoast region in 2022 and 2023. This is making up for the demand of places to live. Locally and state level, everyone is seeing there are so few houses available or being built. Until we see vacancy go above the full occupancy mark (3%), we will assume that the population increase will continue and the ripple effects it has on the rest of the market will move with this market’s demand.

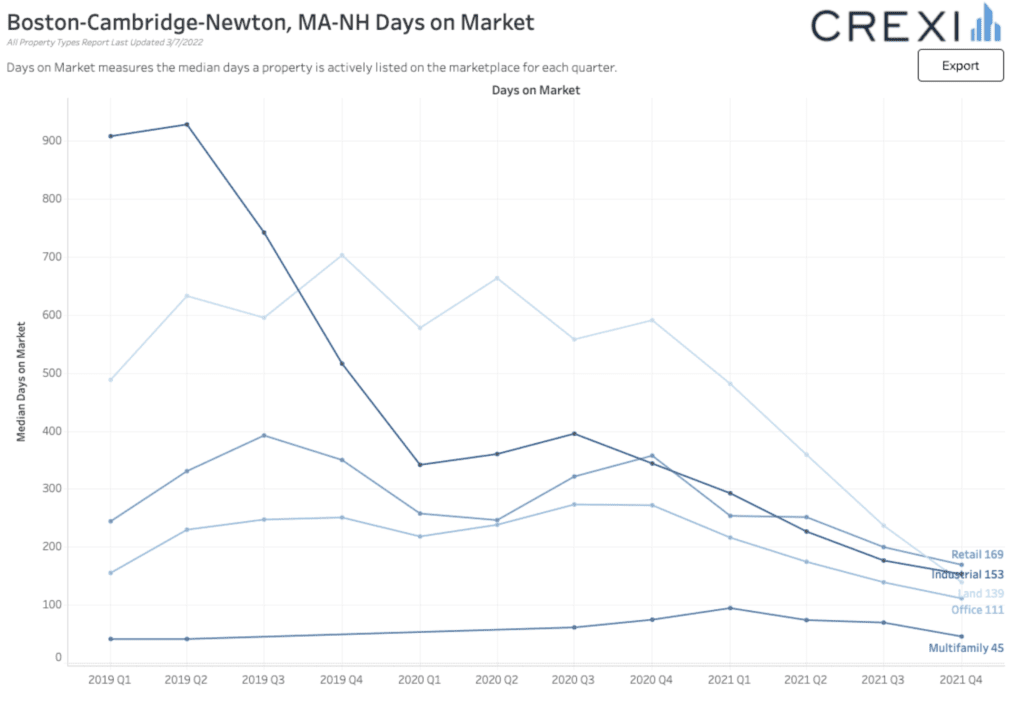

So this makes it clear that a Multifamily is a strong investment for the area – but how much of a correlation are we seeing on the other industry types? What we have seen in the past 3 years is that days on market are decreasing in all the other product types (i.e. Retail, Land, Office, Industrial), but Industrial properties are seeing the greatest increase in demand. We are seeing days on market falling from around 900 days to 153 days and the asking price increasing at the same time.

Land is the other place where the demand has shot off the chart, where 500 days on market turned to 139 days. This means, especially for industrial, there are no places for businesses to build or store materials in this growing market, so businesses are resorting to land in order to build – and this is at a time where building has never been so costly. Unlike a lot of other areas, the Seacoast & Northshore Market have land that is still able to be developed and value to the owner/builder is still there.

It is tough to explain this increase in demand in a single blog post, but note that changes in how retail commerce works, how supply chain management is shifting in a post Covid world, and greater insecurities in a continuing growing market is causing a real need for commercial space. In a market like this, where there are so few residences, the highest and best use is building housing for the influx of people who want to live in this area – creating real growth of rents that landlords can receive and return on owner value for their properties or land.

So while the demand continues to increase, the next question is – “Will this region be able to keep up?”

The Region Will Keep Up at a Steady Pace

One challenge that exists in New England communities is the small town systems. With each town having their own zoning and planning department (which are typically small because the average NH town is just over 2,500 people and the average NH seacoast town is 8,300), these small departments have to lean heavily on input from developers to do their own due diligence in order to get approvals. This makes development not only more costly, but more time consuming. This slow process inhibits communities from taking full advantage of all the businesses that want to move operations to their town – yet it does keep from speculative bubbles being created, allowing the region to be a very stable place to invest. The stability, however, leads to lower rates of return because the risk is much lower.

So while we are seeing additional properties coming available for sale, we still will see growth take time and not necessarily at the rate that investors would like to see for an area in such great demand.

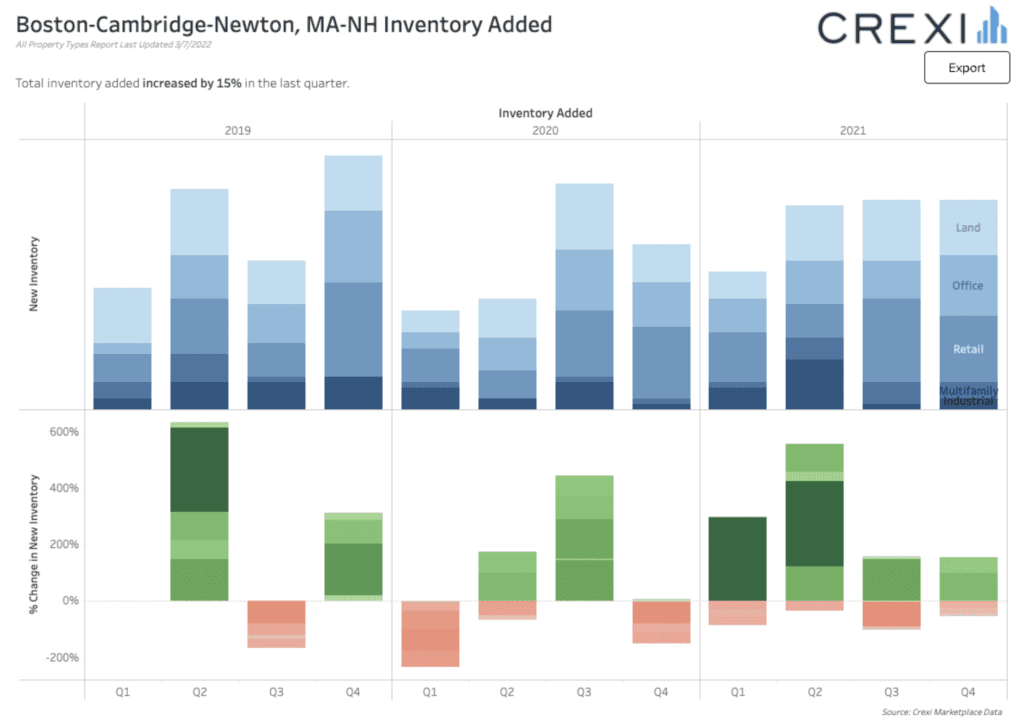

As you can see, new inventory has good months and bad months, but the heart of the situation is that we still see opportunities to invest in this area to this day. With the continuously slow population growth, which is held back based on the demand versus the supply of housing, we can expect to see commercial growth in this region for years to come.

Local and National Investors

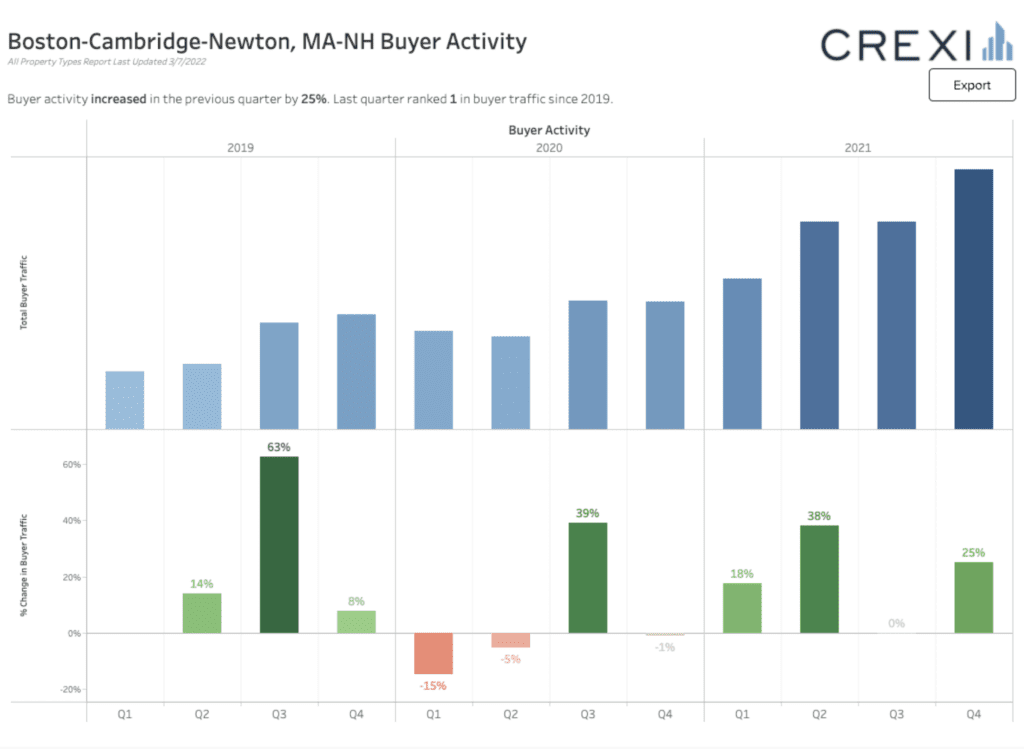

Buyer interest in this region is as high as it has ever been in the past 3 years and is up 25% over the previous quarter. Our team believes based on the activity on our listings that this increase in demand and traffic will be just as high this quarter as it was last quarter and things like increases in the FED’s interest rates will not be slowing down the buyers. In fact we have seen more investors getting out of highly volatile investments like crypto currencies and stocks and turning around to invest in more stable assets like bonds and real estate.

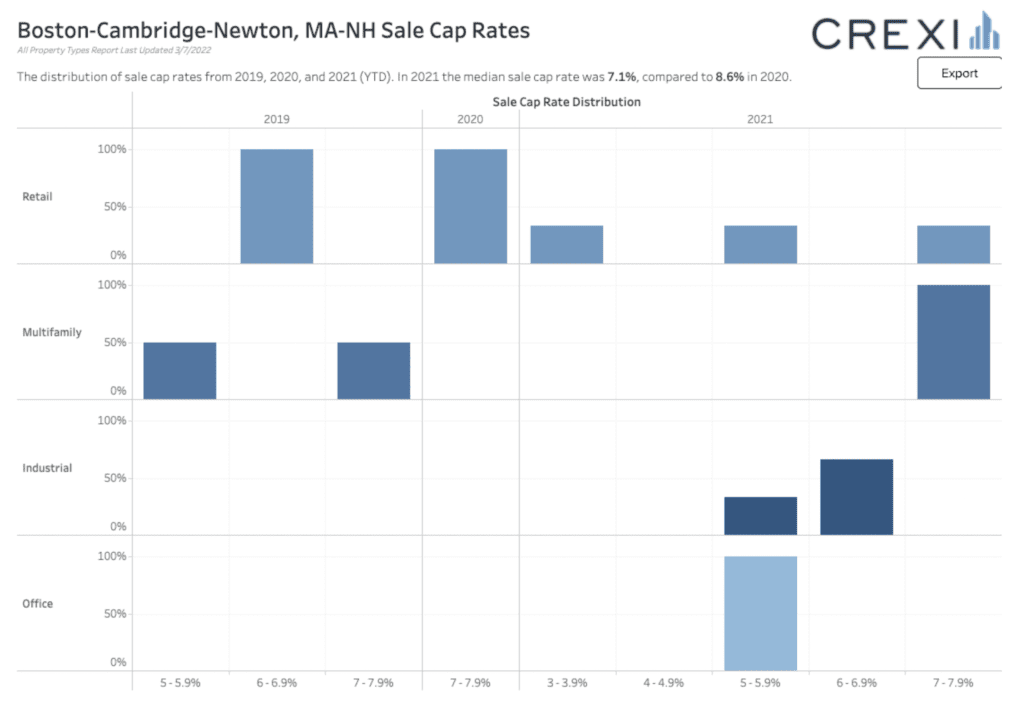

For those looking for the most secure types of real estate investment, the top location in the region seems to be the Seacoast & North Shore. Because of all the factors explained above, there is very little chance of a real estate bubble in this region. Because of this demand to invest in this type of asset (Real Estate) in this market, we have seen this drive down the CAP Rate for investment properties from 8.6% CAP in 2020 to 7.1%.

Final Thoughts

So for everyone who skimmed through this blog post and just looked at the charts and data (it is our go to move as well), our research shows an increase in demand in this area, an increase in regional real estate pricing, and the factors that lead us to believe that just because you have not started investing in this region yet, it is not too late to start.

There are obviously many factors that will increase and decrease demand and prices and we certainly will not predict if Q1 or Q4 of 2022 is the best time to invest, but if you are looking at long term investing in real estate, then the Seacoast and North Shore Market seems to be a very stable investment with excellent upside potential.

– Written by Ethan Ash & Viktoria Alkova