To most people looking around at the American housing market, they see it is as robust as ever. With people putting their house on the market and receiving multiple offers of $20k, $50k, even $100k over list price, it leaves people scratching their heads as we enter year two of the Covid economy. How can unemployment numbers that are double pre -pandemic levels allow housing markets to be the best they have ever been? And the question that is more relevant to many people who read our blog is, how will this affect the commercial real estate market?

Let’s talk about the “macro” and “micro” forces that are affecting the real estate market, which will help explain what we are seeing and how it is impacting and will continue to impact values.

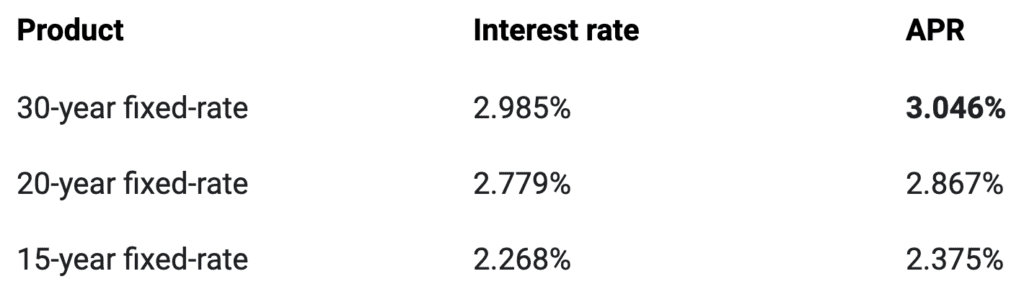

The first macro force that has driven so much of the value of the real estate market is low interest rates. As of today, interest rates for residential loans, according to nerdwallet.com, are:

These are the highest interests rates in over 6 months and all are below the national average. This is making borrowing money so cheap for real estate that many buyers who would be scared off in a recession are still anxious to find and buy a home. The FED’s comments this week about entering a period of higher inflation are what have driven those interest rates up and many experts and consumers believe that interest rates will continue to rise through 2021 and into 2022. Because of this belief, anyone looking to put their property on the market will likely see similar situations of multiple offers of above asking price. Unless they have a living situation lined up, they will have to purchase their next home in this same economic market for the near future. As interest rates continue to rise (assuming things continue to trend in that direction) prices will subtly become more affordable.

Currently, several studies have shown that forbearance on home mortgages are continuing to rise as is the percentage of delinquent homeowners. Anecdotally, there are many people who either have lost their jobs and can no longer afford to pay the mortgage or others who are renting and using this time to build up a nest egg by not paying their rent. The number of mortgages that are in forbearance is roughly 7%. Numbers like this make many investors believe that foreclosures will be on the rise and banks will be unloading properties from home owners that can no longer afford to keep their home in the not too distant future. What we have seen with the increased prices caused by low supply and low interest rates is a new twist; many individuals who can’t afford their mortgage payments are not currently underwater. They could actually sell their property, pay off their loan, and likely walk away with a little money as well – in less time than it would take to go through the foreclosure process. This, potentially, could be good for increasing the supply of homes in our area and create an active market where sellers and buyers are somewhat more in balance than what we have seen through 2021. There is, however, a long way to go for balance.

While the government continues to allow and extend forbearance for mortgage holders, the supply of houses has continued to drive this seller’s market to an extreme that is tough to handle as a professional. Buyer agents know their clients are putting in offers that will have 15-20 competing offers. Without increasing escrows, removing contingencies, or coming well over asking price, their buyers don’t have much of a chance to get a home. The lack of options is also causing people who want to sell their home to hesitate because they have no idea where they would live. There are few places to move to, and would the home they buy be better than what they have?

When this happens, typically it causes home builders to buy up more land and build more houses. Yet, with dramatically increasing construction costs, due to lack of materials, and far too few builders in the industry to build homes, the deficit number of housing units built versus growth in population leads to the continued lack of inventory. The only things that are being built in large numbers are apartments, which causes more people looking to live in the area to rent versus own – on a temporary basis at least. Single family homes allow more wealth in the economy to be held by a broader segment of the populace than when renting from large real estate companies holding apartment complexes. However, the apartments allow for a more diverse demographic to afford to live in the area than only single family homes. While towns are being very cautious about how many lots are being created and how many homes they are allowing to be built, they should be cautious because it impacts the environment and can put a strain on community resources such as schools and town utilities. More units and development spreads the cost around the taxpayers. Arguably, these policies are causing a great deal of economic inequity and contributing to the lack of inventory all around. Some of these policies have also led to declining school enrollments across the state.

When it comes to the commercial arena, there are substantial effects. As land experts, we are very very busy, not only with both larger parcels and subdivisions for residential purposes, but also for industrial and commercial purposes. Inventory of lots is very low in addition to the residential homes. The time and money required to complete a residential subdivision has become problematic as well. In general it will take most applicants at least 6-12 months to complete a subdivision, and then it is subject to appeals from abutters. This all slows down the number of lots to the market, keeps the inventory low, stifles new construction, and lowers any potential future inventory.

On the industrial side, we are facing the same inventory problems with very little square footage available for lease or sale. The lack of inventory is now pushing parties to investigate the build or buy analysis. This starts to put pressure on the land because, similar to the residential inventory, the industrial land inventory is also very low, and the time to market is taking longer all the time. The required work leading up to a new land parcel coming to the market is long and is arduous, and very expensive. Again, the more difficult it is, the lower the inventory.

The standard over the last 10-15 years has been that the housing for employees needs to be first, then followed by the industrial growth. This has actually been the case particularly on the NH seacoast, but the slowdown in availability of the residential inventory has been affecting the industrial market over the last few years. Exacerbating this over the last year with the pandemic is the migration of businesses from Massachusetts and Connecticut to New Hampshire. Whole companies picking up and moving their business and as many employees as want to move to the state. This has, again, helped to create the lack of inventory for residential land and housing. Both low interest rates and the fact that there have been policies in place through the SBA that provided strong incentives for new businesses are a strong pressure on the market.

What is the bottom line? The demand is likely to continue, both in the residential and the industrial markets! The solution? Towns and cities need to roll out the welcome mat to not only the industrial users, but also the residential new home and new apartment market in order to start to alleviate the severe lack of inventory. There needs to be a concerted effort to streamline the process and make it affordable for developers and home builders to create new inventory!